The FGTS (Severance Indemnity Fund) is a guaranteed benefit for all Brazilian workers , and this amount can make all the difference in your daily life. But what few people know is that you can withdraw your FGTS benefit early , and that's why we've prepared a complete step-by-step guide for you to access this amount quickly and easily. Check it out!

The longer you work, the higher your FGTS (Brazilian severance pay fund) balance will be, as it consists of monthly deposits that your employer is required to make into your FGTS account. Each month of work results in 8% of your salary, meaning that after a few years of work you will have a fund worth more than your salary. And the best part is that you won't have to wait long to withdraw it, check it out!

Under what situations will I be able to withdraw funds from my severance pay fund?

Access to this fund will be granted in special situations such as dismissal without just cause, treatment for a serious illness, or when purchasing a home. However, it's worth remembering that nowadays there are other options that may allow early access to the benefit. See more situations in which the benefit can be withdrawn:

- Achieving retirement.

- Emergency situations

- Birthday Withdrawal

- In the acquisition and settlement of real estate loans.

It is important to note that the benefit conditions may be updated on the Caixa website, considering that new legislation may bring changes in the future.

FGTS advance: Birthday withdrawal

This option makes it much easier to withdraw a portion of your Guarantee Fund (FGTS) in advance. This is because the FGTS Birthday Withdrawal doesn't require exceptional circumstances; simply opt for this option and make the withdrawal in the month corresponding to your birthday. However, to do so, you will need to consult the official withdrawal schedule, as your birthdate will have a different day for you to access the funds!

It is also very important to highlight that this withdrawal option is optional. And if you choose this method, you cannot combine it with the severance withdrawal. In other words, every worker will have the option to choose the criteria for releasing their FGTS (Brazilian severance fund). That is, those who use the anniversary withdrawal can withdraw once a year, in reference to their birthday.

But in order to withdraw this amount, you will need your NIS number, and you will have to follow our step-by-step instructions to learn how to access your balance through the Caixa website:

- FGTS Birthday Withdrawal: Step by Step

Here's a complete step-by-step guide to requesting and withdrawing your FGTS (Severance-Birthday Guarantee Fund):

- First, you must download the FGTS app on your smartphone. It is available in your phone's app store.

- Open the app and create an account. If you already have an account, simply log in with your username and password.

- When you enter the app, select the Birthday Withdrawal option. If you are enrolled in the Termination Withdrawal option, you can change options through the menu. Remember to confirm the Birthday Withdrawal category to proceed to the next step.

- Add a bank account to receive the benefit. After opting for the Birthday Withdrawal option, you need to choose which bank account you want to use to receive the amount when your birthday month arrives.

- Simulate the withdrawal amount: It's possible to simulate the money you'll receive even before your birthday. This option is available directly through the app, which has an official simulator. The Caixa Econômica system calculates how much you can receive when you apply for the benefit. This feature is great for helping with your financial planning.

- Birthday Withdrawal Amounts

Although this option has the great benefit of making annual withdrawals much easier, it's worth remembering that the Birthday Withdrawal only releases a portion of the Guarantee Fund's value.

This means that, most of the time, this category releases smaller amounts than the Termination option. In other words, while the anniversary withdrawal makes a portion of the FGTS (Brazilian severance fund) available every year, the other options are more difficult to access, but can release a larger percentage of the fund all at once.

Table of FGTS (Brazilian Severance Indemnity Fund) Values for Birthday Withdrawal:

- Up to 500.00 > Rate: 50% > No additional charge

- 500.01 to 1,000.00 > Tax rate: 40% > Additional tax: 50.00

- 1,000.01 to 5,000.00 > Tax rate: 30% > Additional tax: 150.00

- 5,000.01 to 10,000.00 > Tax rate: 20% > Additional: 650.00

- 10,000.01 to 15,000.00 > Tax rate: 15% > Additional: 1,500.00

- 15,000.01 to 20,000.00 > Tax rate: 10% > Additional: 1,900.00

- Above 20,001.00 > Rate: 5% > Additional: 2,900.00

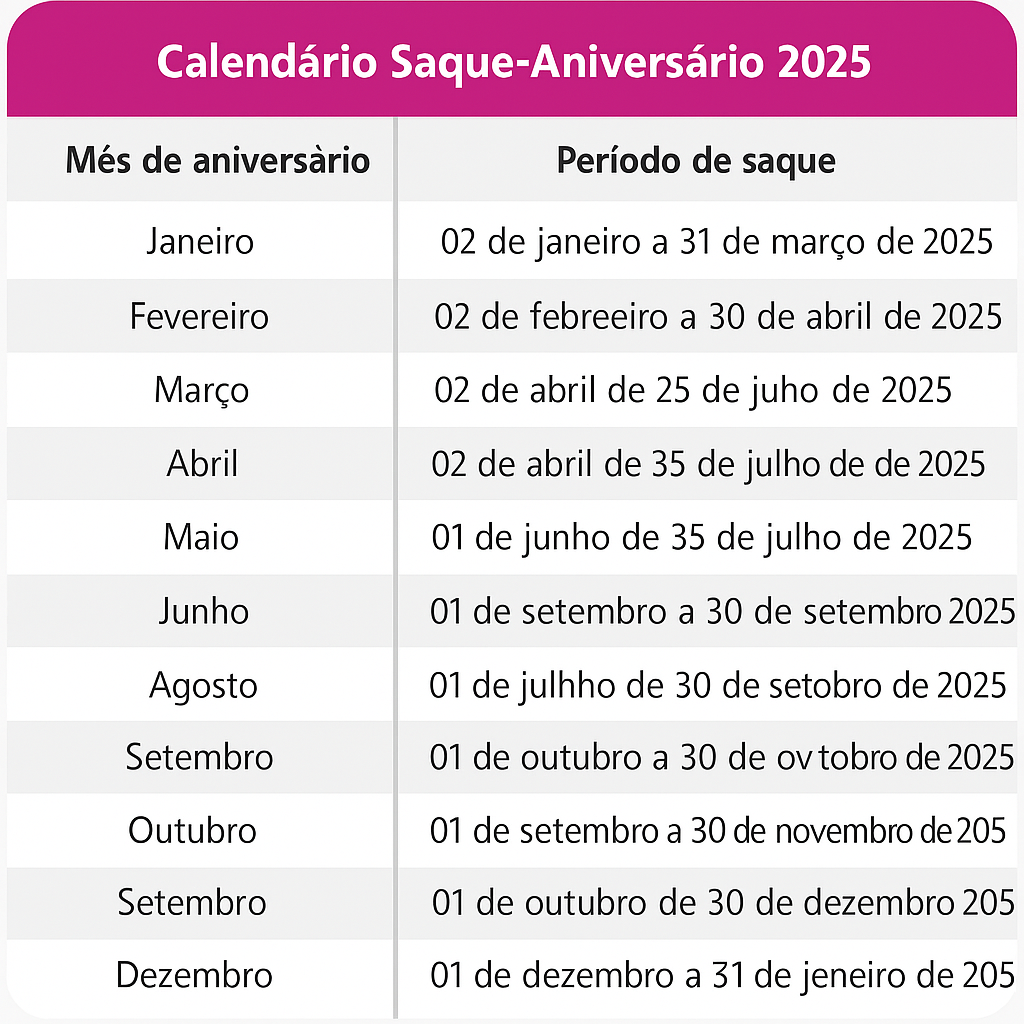

- FGTS Calendar